Account Book is an app which helps you to control your finances. Who doesn't know that feeling of having less and less money in your account at the end of the month eventhough you haven't bought anything special? This is where keeping a household account book comes in handy. But how many actually do this? Sitting down every day and detailing your exact spending only to find that at the end of the month your bank account still shows the same deficit as before.

This app will help you to order your finances in an easy way. Due to the clear and simple layout, you can enter your daily expenses and incomes in only a few seconds.

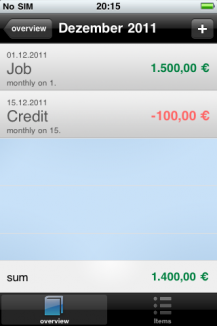

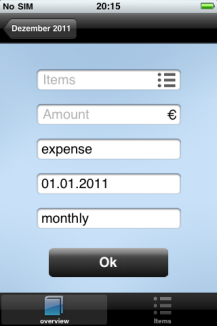

Initially, it is advisable to enter your monthly fixed costs (e.g. rent) and income (e.g. salary) to have them calculated as a flat rate by this clever app. This way you don't have to deduct your rent every month or add your salary...but rather this is done for you automatically. This app can automatically deduct or add a fixed amount monthly or annually, so you are spared a lot of work.

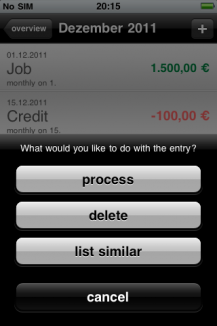

Simply enter your flexible expenses each time and add a short commentary if you like. So if, for example, you go shopping simply enter that you spent € 20 at the shops. The date is then automatically added and your expense is booked.

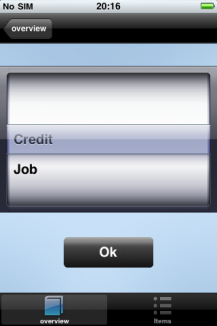

Next time you go shopping, you don't have to type in "Shopping" as this item will be suggested to you automatically. Simply add the amount you spent.

Of course, this system works the other way round as well. When you have income, for example you sell your old television on Ebay and earn € 50, you can book that amount in just a few seconds and this way never lose overview of your finances.

So you don't lose the complete overview however, you can also have graphically displayed in which month you had a positive or negative balance. This way you can oversee the whole year and determine when you spent a lot and on what you spent your money on.

To recognize in advance when it could become difficult at the end of a month again, it is displayed to you what percentage of the month still remains and how much money you have at your disposal. This way you know in advance, for example, that you still have half the month to go but only have € 200 to spend. Therefore, start saving!

This app is an investment which pays for itself on day one and turns into profit after that.

Additionally, it should be mentioned that studies have proven that people who use (household) account books handle their money more consciously and end up with more money at the end of the month than people who do not. This is mainly explained by those people asking themselves if they really need that € 2 packet of chewing gum or if it is simply a pointless expense which will haunt them at the end of the month.

More Apps

About us

The idea of creating an own app appeared to me on a train ride with such miserable internet connection that the documentation of xCode unavoidably had to serve as reading material. And with that the first idea for an app was born: Mia with a fake button, a dice game with a cheating mode.

In the meantime, there is whole team sitting behind the apps, developing more than 100 apps for iPhone and iPad and uploading them into the iTunes Store. Even in the Android world you can find some gimmickry. Whether there’s a virtual pet living in your mobile phone, football gamblers competing against each other and the results, paper plane instructions being used in a restaurant, serving the perfect Sunday breakfast egg or filling your brain with some not so unnecessary knowledge, the apps are fun and enrich the drab monotony of everyday life. Regular Top Ten rankings in the App Store, right up to #1, show that the ideas have the finger on the right pulse.

The creative head behind the Lochmann Apps is Benjamin Lochmann, who is known to be a passionate computer programmer and at the same time the CEO of the Benjamin Lochmann New Media GmbH.